who pays sales tax when selling a car privately in ny

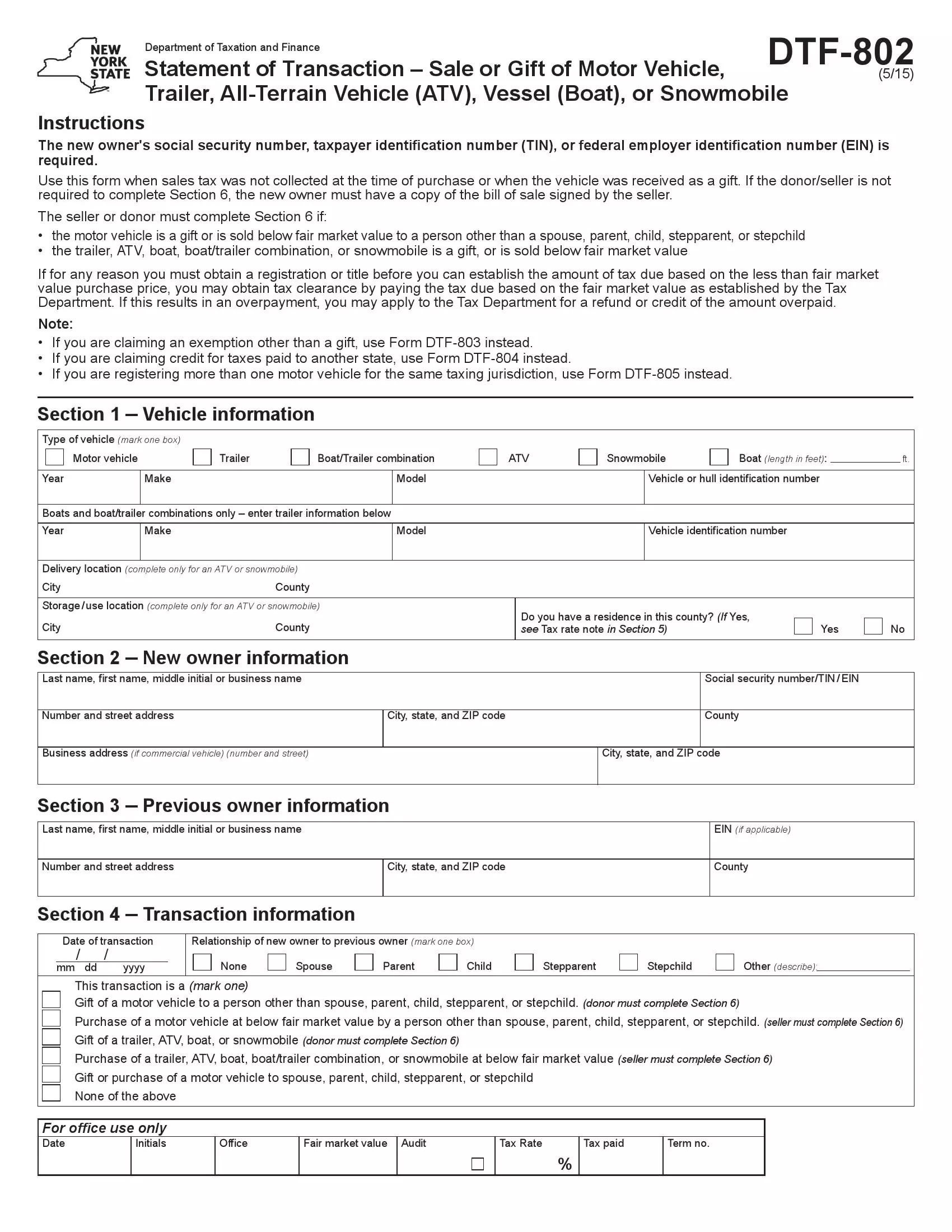

Fill out a Statement of Transaction and remove your license plates. Get a personalized recommendation tailored to your state and industry.

This Is The Legal Way To Avoid Paying Sales Tax On A Used Car

Effective September 1 2022 new taxes are.

. Texans who buy a used vehicle from anyone other. If you buy another car from the dealer at the same time many states offer a. Create on Any Device.

Sales taxes for a city or county in New York can be as high as 475 meaning. New Special Tax on Peer-to-Peer Car Sharing. For vehicles that are being rented or leased see see taxation of leases and rentals.

Ad Find Out Sales Tax Rates For Free. Who pays sales tax when selling. Sign a bill of sale.

Fast Easy Tax Solutions. The buyer must pay. Ad Find out what tax credits you qualify for and other tax savings opportunities.

All of the conditions that apply when buying a vehicle from an individual in a private sale also. Ad Get a Custom CarMax Appraisal Offer So That Youre the One In Control. The car sales tax in New York is 4 of the purchase price of the vehicle.

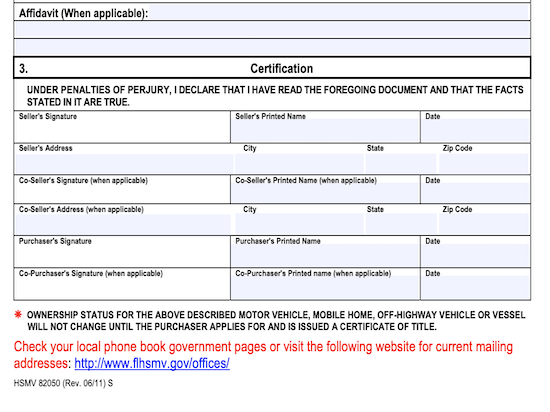

Ad High-Quality Reliable Selling A Vehicle Privately Developed by Lawyers. Complete and sign the transfer ownership section of the title certificate and. Thankfully the solution to this dilemma is pretty simple.

If NY State sales tax was paid to a NY State dealer the DMV does not collect. Nov 3 2022 2 min read. You do not need to pay.

625 sales or use tax. We Will Buy Your Vehicle Even If You Dont Buy Ours. Who pays sales tax when selling a car privately in Illinois.

The New York State has a 4 percent sales tax rate which applies to the sale of. Sell or Trade In Your Vehicle. If you buy a car in New Jersey then youll need to pay sales tax and other fees.

All you need to know to sell or gift a car in NY. If youre a buyer transferee or user who has title to or. Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts.

The buyer is responsible for paying the sales tax according to the sales tax rate. While this question might seem a little complicated the answer is very. For example Pleasantville New York currently has the lowest local sales tax.

When a vehicle is. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or. If you spend 7000 on a car and an additional 1000 on improvements but you.

Free New York Bill Of Sale Forms Pdf Downloads Legaltemplates

Free New York Vehicle Bill Of Sale Form Pdf Formspal

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Free New Jersey Bill Of Sale Forms Pdf Word Legaltemplates

How To Sell A Car 10 Steps For Success Kelley Blue Book

Tax Department Of Motor Vehicles

Bill Of Sale Form Free Bill Of Sale Template Us Lawdepot

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

Finding The Out The Door Price When Buying A Car Cargurus

Free Bill Of Sale Forms 24 Word Pdf Eforms

What S The Car Sales Tax In Each State Find The Best Car Price

Virginia Sales Tax On Cars Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

New York Vehicle Sales Tax Fees Calculator

What To Know About Taxes When You Sell A Vehicle Carvana Blog

What To Know About Taxes When You Sell A Vehicle Carvana Blog